Why Updated of Accounting Record is Crucial for Companies?

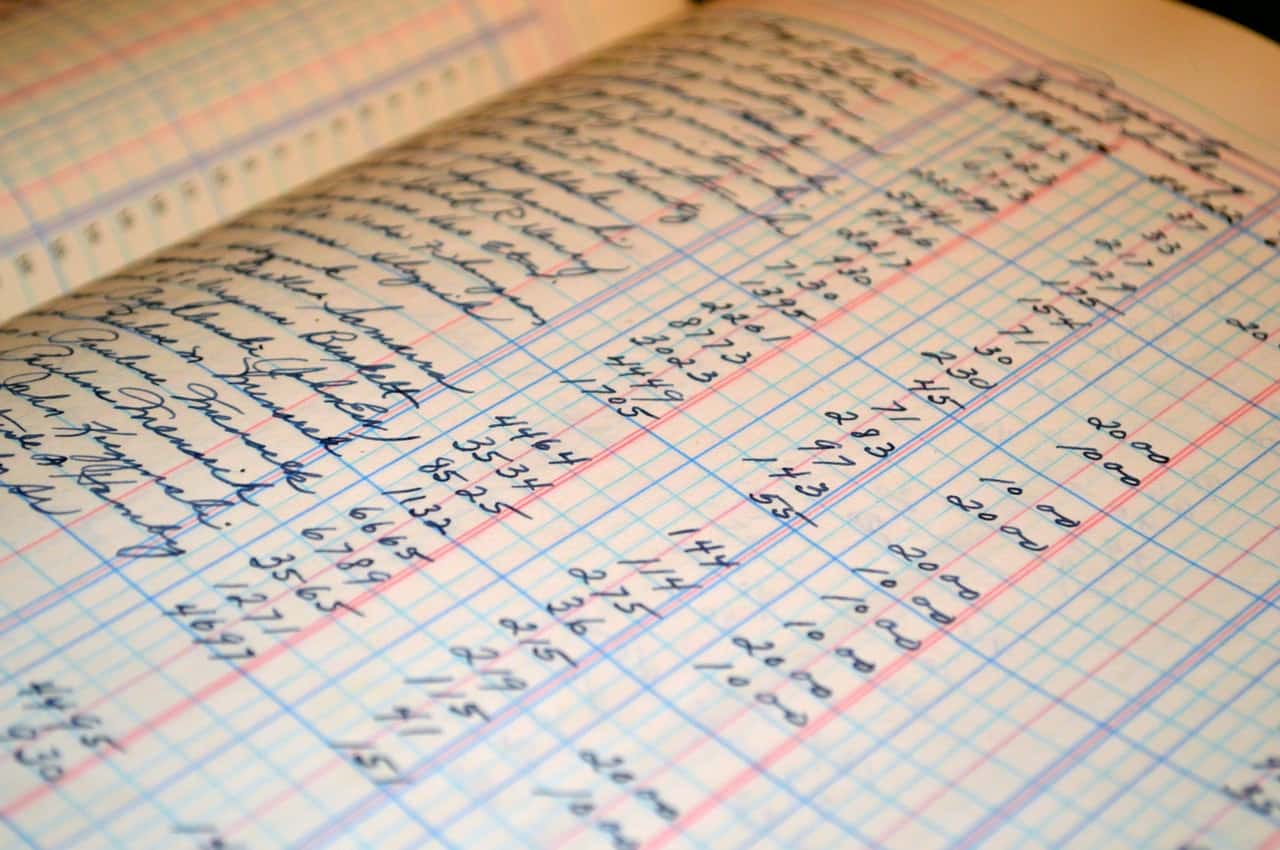

When you are running a company in this world, regardless of its location, the most common term that you come across in daily routine is Accounting Records. Even a layman understands that accounting includes the process of summarizing, recording and analyzing the financial transactions of a company. In order to understand why updated of accounting record is crucial for companies, let us discuss various aspects of business accounting.

Accounting of a company can be divided into various categories like management accounting and financial accounting etc. Though both of these accounting options are related to the same business but management accounting reports information used internally whereas financial accounting focuses on reporting statutory information.

Importance of accounting service for a business

Accounting service is important for a business as deals with financial aspects of the business so that quantitative information can be provided its stakeholders including investors, financiers, suppliers and government etc. so that they can make some economic decisions on its basis. Updated accounting records can help in taking long term and short term decisions for the benefit of the company and its stakeholders.

The accounting service of a company mainly generates three types of statements including:

Income statement or Profit & Loss Account

This statement shows net income as well as net losses of the company in a specific period of accounting.

Financial statement or Balance Sheet

This statement shows the financial status of the company on a certain date. It includes closing balances of the liabilities and assets of the company. The difference between the assets and liabilities is termed as capital of the company.

Statement of Cash Flow

This statement shows the effect of income statement and balance sheet on the flow of cash and equivalent items of the company. In fact, it shows the outflow and inflow of cash between financial, operating and investing activities of the company.

The financial statement required by the stakeholders of the company can be derived by combining all the three statements discussed above.

Importance of updated accounting records for a company

Updated and clean accounting records are important for a business in today’s business environment due to following reasons.

- Evaluating the performance of the business

- Monitoring and managing cash flow

- Legal compliance of the business

- Creating budget for future prospects

- Tax planning

In this way updated accounting reports are very important even for day to day activities of a business.

Consequences of non-updated accounting reports

Many major companies in Malaysia have to face financial losses in year 2000 due to frauds of accounting services. The independent auditors of these companies failed to find out illegal practices of accounting services. These accounting scandals and frauds became the main reason of fall of a well known accounting firm of US, Arthur Anderson. There are many other similar instances as well.

Conclusion

The information provided in this write-up helps in concluding that updated accounting reports help a business in managing its day to day activities along with planning for its future expansion. The stakeholders of a company can take important decisions if the financial reports are properly maintained and updated regularly.

Recent Posts

Why Updated of Accounting Record is Crucial for Companies?